- Continued sales momentum -

- Strong operational progress -

- Significant deleveraging -

Morrisons has today updated investors on its Q2 performance, covering the period from January 29th to April 28th 2024.

Key highlights

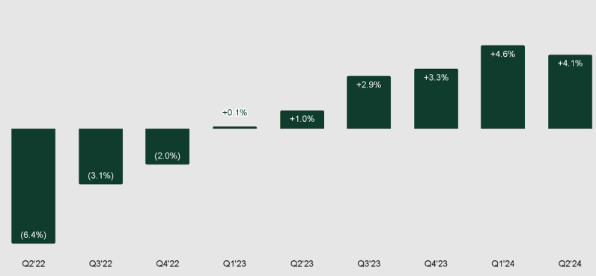

- Group like-for-like (LFL) sales ex-fuel/ex-VAT up 4.1% (2022/23: up 1.0%)

- Total sales ex-fuel £3.8 billion, up by 3.7%

- Underlying EBITDA for H1, excluding the fuel business, up 16% to £321 million

- Good progress across our three strategic pillars: commercial excellence, operations optimisation and new value creation

- £2.5 billion sale of Petrol Filling Station business to MFG completed

- Further investment in the Morrisons More Card; swipe rate increased to c.50% and targeting 70% in the medium term

- Successful conclusion of debt reduction tender in June 2024; Group debt now reduced by 35% to £4.0 billion from peak of c.£6.2 billion

- 38 convenience stores acquired in the Channel Islands from SandpiperCI

- McColl’s conversion programme now complete; targeting a total of 2,000 Morrisons Daily convenience stores across the UK in 2025

Like-for-like sales growth excluding fuel

Rami Baitiéh, Chief Executive Officer, said:

“I am pleased with the overall performance of the business in the second quarter with supermarkets, convenience, wholesale and online all delivering growth and contributing to a 4.1% increase in like-for-like sales.

“Over the last eight months we have listened carefully to over 340,000 customers, colleagues and suppliers and the insights from this exercise are helping to refine and shape the activity in all three pillars of our strategy: commercial excellence, operations optimisation and new value creation. It’s clear that availability and our loyalty scheme are the two areas our customers talk about the most and so we are focusing intensively on these areas.

“Our Aldi and Lidl Price Match, introduced in February, has had a great start and is giving customers increasing confidence in the competitiveness of our prices across the shop.

“Convenience remains an important and strongly growing channel for us. With the McColl’s conversion programme now complete and the recent acquisition of 38 stores in the Channel Islands, we have over 1,600 Morrisons Daily convenience stores across the country, about two thirds of which are wholly owned. With this strong growth trajectory we are now targeting a total of 2,000 convenience stores in 2025.

“Customer reaction to the significant investments we have made in the More Card has been very positive. We now have over five million active customers, and transactions using the card have grown by around 35% in the last eight months. We are now targeting 70% of transactions to be through the More Card over the medium term.

“This summer we are celebrating 125 years since Sir Ken Morrison’s father established the very first Morrisons store. This important milestone is a great platform to remind customers of the timeless values that Sir Ken built into the company and how our Market Street counters and our 18 food making factories set Morrisons apart. Embracing, preserving and enhancing his legacy is the foundation for building the Morrisons of the future.”

Jo Goff, Chief Financial Officer, said:

“This has been another solid quarter of progress with sales and volume improvements right across the business. Our debt has now reduced by over a third and we made further progress on our cost savings programme with £78m delivered in the quarter, taking the total since the start of last year to just over £450m, in line with our £700 million three year target.”